With Forexland you can start trading CFDs on precious metals such as gold and silver. Trade gold, silver, platinum or palladium CFDs without the need to buy the physical metal. You can access online trading and explore metals trading, expanding your portfolio and hedging against potential risk.

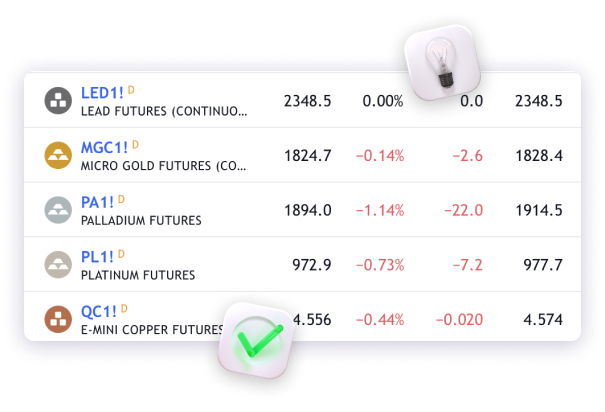

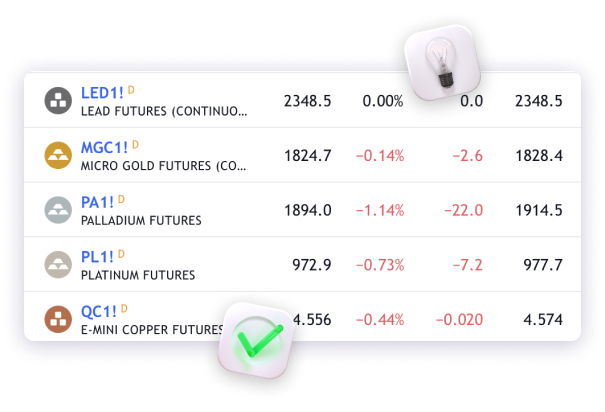

Metals can be traded on the London Metal Exchange (LME), the New York Mercantile Exchange (NYMEX) and the Shanghai Gold Exchange. Trading CFDs on hard metals such as gold, silver, platinum and palladium allows investors to speculate on the price movement of the commodities market. Traders usually prefer trading CFDs on gold due to its popularity and status as a safe-haven asset which tends to rise in times when markets are down. Platinum, palladium and silver are also popular due to their uses in industrial manufacturing and jewellery.

Short or long positions

With Forexland, you can buy and sell CFDs on gold and silver with low spreads and fast execution.

Safe-haven investment

Trading CFDs on metals is considered as a safe haven investment, especially at times of political and economic uncertainty.

Diversification

Metals trading is usually used by traders to balance and diversify their portfolio. For example, gold is traded to hedge against currency devaluation or high inflation. As a safe haven asset, it is also traded to hedge against US dollar volatility, while silver has been traditionally used to hedge against currency volatility.

All trading involves risk.

It is possible to lose all your capital.

Trading Conditions and Specifications

Header

| Symbol | Average Spread |

Swap Rate Long |

Swap Rate Short |

|---|---|---|---|

| XAUUSD | 0.25 | -4.83 | -6.58 |

| XAUEUR | 0.28 | -28.18 | -19.75 |

| XAGUSD | 0.16 | -1.74 | -5.80 |

| XAGEUR | 0.19 | -14.23 | -3.45 |

| XPTUSD | 3 | -7.01 | -7.91 |

| XPDUSD | 26 | -8.45 | -15.68 |

Table of Spreads

Important note:

The above spreads are applicable under normal trading conditions during day trading sessions.

However, there may be instances when market conditions cause spreads to widen beyond the typical average spreads displayed above.

*All spreads are indicative, to view real time values clients should refer to their client terminal.

Forexland is a trade name of FXland Limited. This website is operated by FXland Limited with company number 120473 and registered address at Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Marshall Islands MH 96960.

Risk Warning:

Our products are traded on margin and carry a high level of risk and it is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved.

Forexland does not offer its services to residents of certain jurisdictions such as USA, Iran, Cuba, Sudan, Syria and North Korea.